How were the BRED Group’s results in 2021?

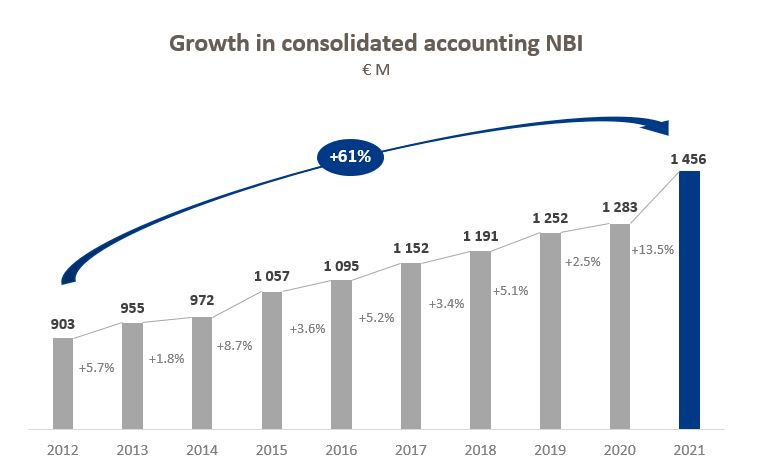

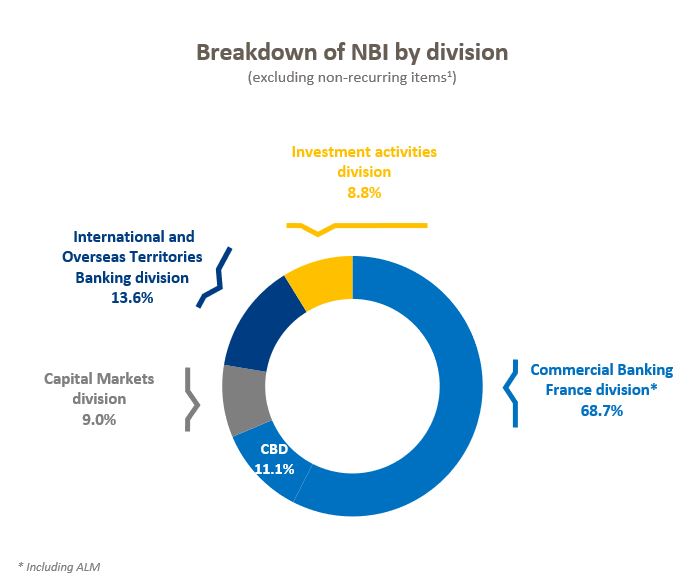

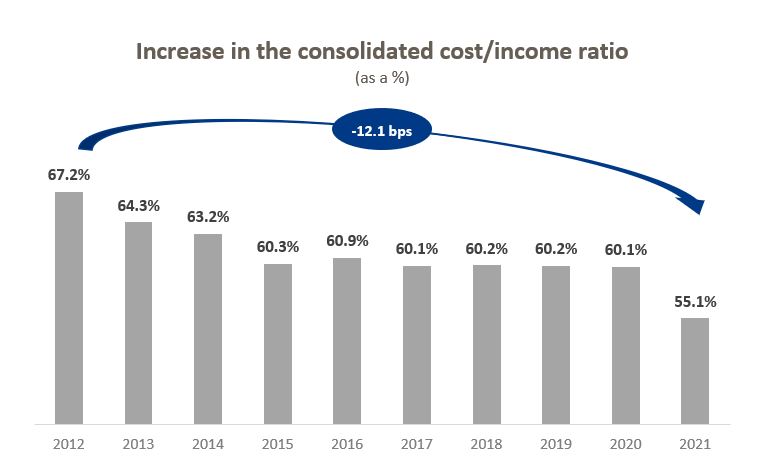

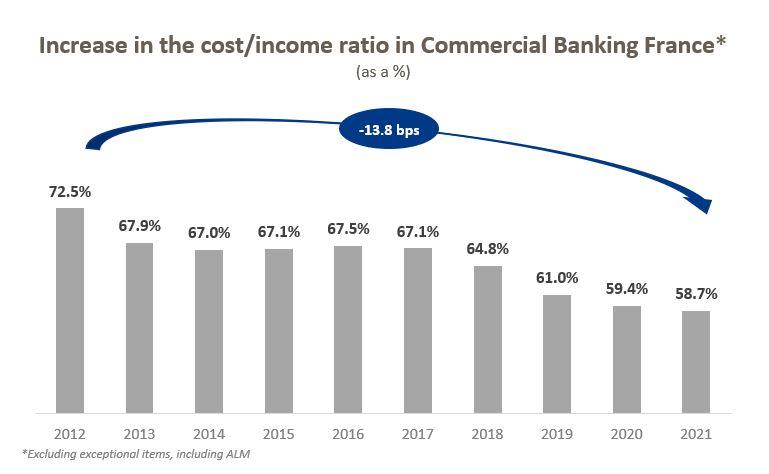

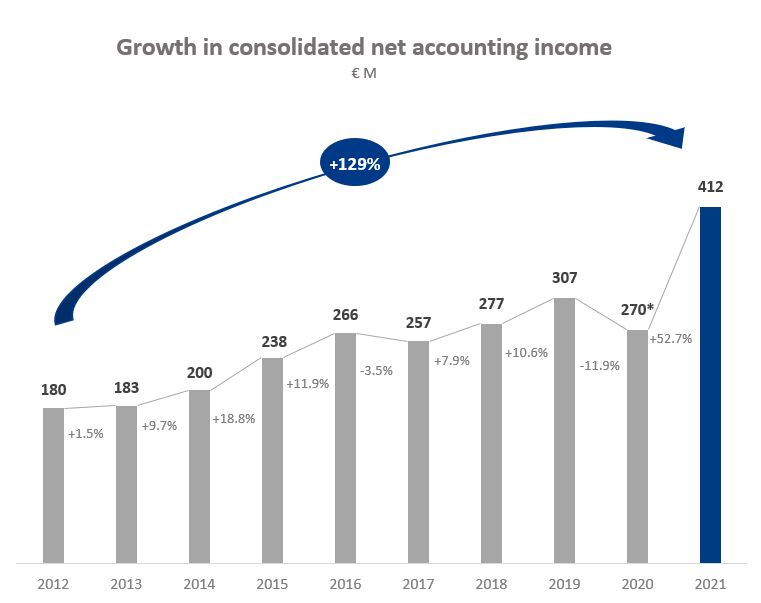

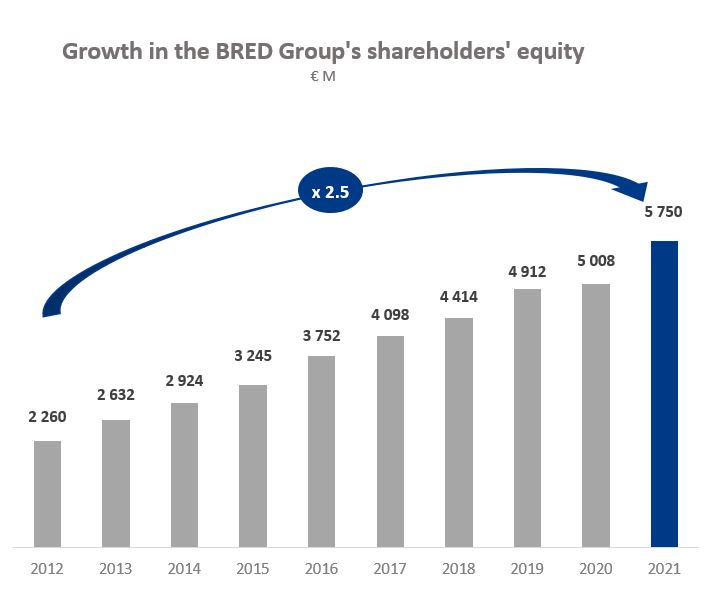

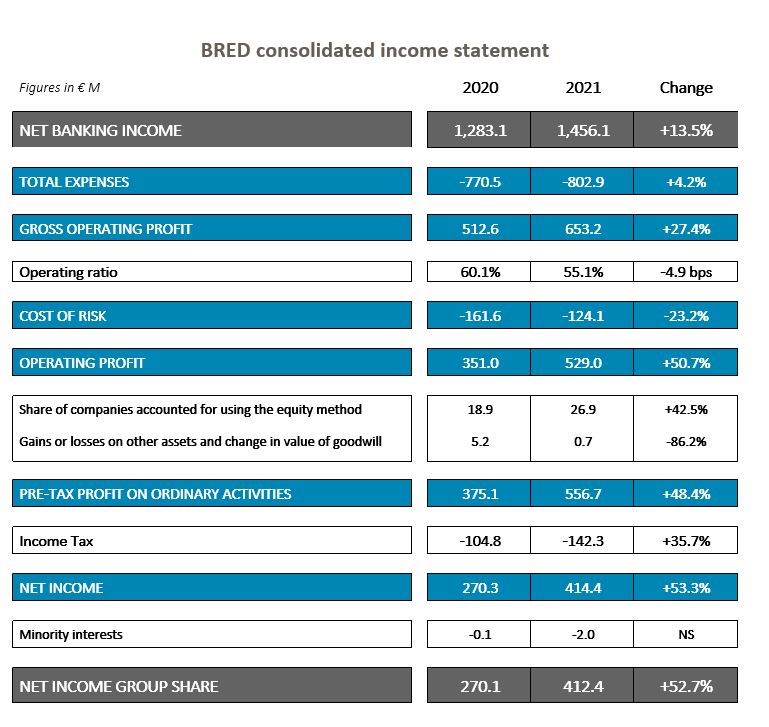

The BRED Group achieved excellent results in 2021, with an NBI of €1,456m and net income of €412m, up respectively by 61% and 129% since 2012. The BRED Group’s cost-to- income ratio of 55.1% and the change in its shareholders’ equity emphasise the effectiveness and strength of our bank, and its ability to contribute, alongside its customers, to the development of its territories.

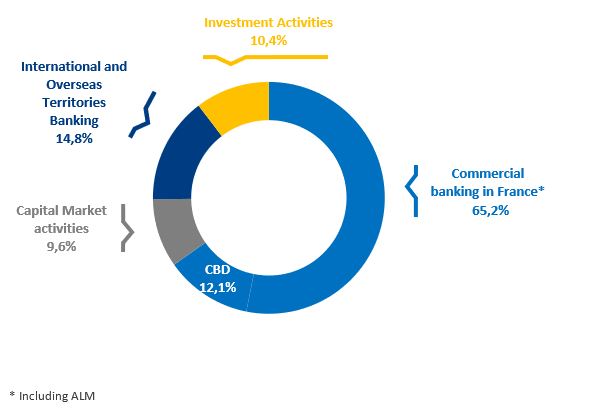

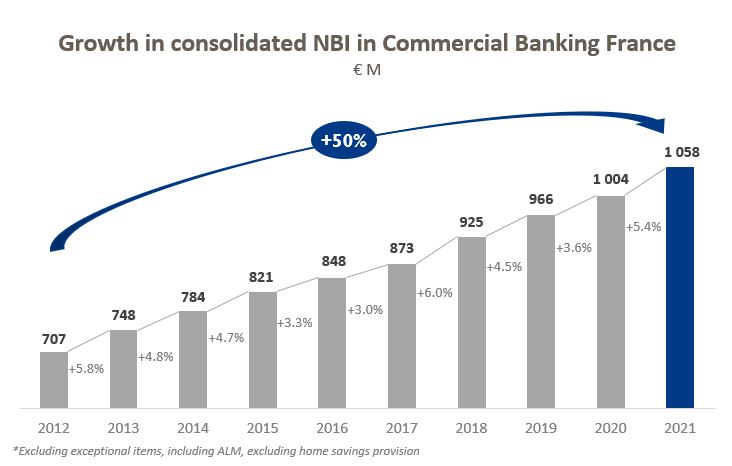

These achievements are driven by all of our businesses, and in particular by commercial banking in France, which recorded an increase in revenue in 2021 of 5.4% and a continuous cumulative increase of 50% since 2012, thereby easily outperforming the market. Abroad, the BRED Group has also strengthened its positioning with growth in NBI of 25.7% at constant exchange rates, despite the closure of borders due to the pandemic in some countries where we are present. Finally, our trading desk maintained a very good level of earnings.

2021 was also a year in which BRED achieved recognition. In particular, it was chosen by the European Commission to place its bond issues, won second prize in the category “best affiliated private bank” at the Sommet du Patrimoine et de la Performance, won an award for the best banking individual retirement savings plan on the market, and was awarded the Label of Excellence by the Dossiers de l’Épargne. Not forgetting that its subsidiary in Laos was named the best corporate bank in the country.

However, beyond the figures and awards in 2021, what I retain above all from that year, and what represents our main source of collective pride, is the relevance of the strategy introduced ten years ago: banking without distance, which has given rise in recent years to “100% advisory banking”. This strategy is an unprecedented source of resilience in an environment that is still heavily constrained by the structure of interest rates, the technological revolution, and more recently by the health crisis. It has guided all our decisions to combine the protection of employees with support for our customers and territories. Applied to each of our businesses, it has enabled us to achieve outstanding performance over the last ten years.

What is the strength of the “banking without distance” strategy?

Behind this approach and at the basis of our culture of efficiency is a multidimensional philosophy of proximity and added value.

Local proximity to our customers first of all, which we have endeavoured to strengthen in recent years and to significantly improve. Indeed, banking without distance shows the BRED Group’s ability to meet the ever-increasing expectations of individuals, professionals and companies of all sizes, both in terms of the overall long-term relationship and of services and advice. It shows the relationship of trust that we are continually striving to enhance: trust in our ability to support our customers on a long-term basis in their personal or corporate projects. Trust as well in our ability to meet their needs for financing, sound investments and data protection.

This philosophy also covers our proximity to the territories. We are a cooperative bank, with a particularly strong role in the territories where we are established, both in France and abroad. We are in perfect harmony with them, with converging interests. If one day, one of our territories shows lower profitability than others, the savings collected there will be used to finance the development of projects in those territories, and will not be allocated to another territory offering better profitability.

The third aspect of proximity concerns decision-making; our customers know the people ultimately in charge at BRED and its banking subsidiaries, and decisions are made at the most local level.

Finally, managerial proximity, which is just as essential, because commercial banking is a business that involves consulting, and the ability to mobilise teams to support customers sets us apart. Our employees are involved in the strategy, we give them the keys not only to understand it but also to be key players in it.

The added value of advice to all our customers is one of the foundations of our strategy. Customers, who are better- informed and more exacting, expect to have advisers who can meet their specific needs, and who are highly competent. This is what the BRED Group strives to offer and which has resulted in the emergence of “100% advisory banking”.

The BRED Group works in two related but different worlds: those of transaction banking and advisory banking. How has your banking without distance strategy affected the way you deal with convergent but different needs?

Banking without distance means knowing that it is essential to be one of the best players in digital technology, but this is not enough. The future of the BRED Group is therefore also rooted in the philosophy of an overall close relationship that we mentioned earlier.

Based on this conviction, we have created a banking model that is as efficient in the field of transactions as online- only banks, but with a crucial extra element that makes it possible to completely satisfy customer requirements: high value-added personalised support. We have undertaken to enhance the overall close relationship that BRED maintains with its customers, in each of its territories, by focussing our thinking on human capital, which is irreplaceable. Far from closing our branches, we have reorganised them to dedicate them entirely to advisory banking. We have continued to train our employees in order to perfect their expertise in the customer segment they cover, thereby improving our quality of advice, responsiveness and proactiveness.

At the same time, we have invested heavily in new technologies to offer a better customer experience, in particular with a daily banking application recognised as one of the best on the market. Furthermore, we have used digital technology to free our advisers and support departments from low value-added tasks. Finally, we have developed non-banking services.

How is your status as a cooperative bank also a strength?

Although our banking without distance strategy has guided us for almost 10 years, the cooperative dimension represents our roots. Our members are customers, men and women from all sectors who contribute to the economic and social dynamics of the territories where we are present.

This model meets our customers’ expectations, as is shown by the success of BRED’s capital increases.

Thanks to this original status, BRED’s strategy does not depend on the financial markets, their volatility and herd behaviour, such as the very short-term pressure they impose.

Our cooperative model looks to the long term, and is inclusive and committed to the territories, and is therefore more relevant than ever, as in essence it tackles the major transitions currently under way, and makes the issue of social engagement central to our model, our strategy and our governance.

As a cooperative bank, without distance, BRED combines a philosophy of proximity and added value, with a culture of efficiency and collective share ownership.

To cope with the challenges of the future, it will continue to deploy this joint model of capitalism with a positive impact, in which the customers and members, as well as the employees and the company as a whole, are central to its strategy.

Read BRED’s full 2021 activity report