Category: Bank

As we all know, and contrary to what we sometimes read, low interest rates are not in themselves a bad thing for banks. For them, what matters is not so much interest rates as the slope of the interest rate curve. Note that in France, for example, loans, such as home loans and investment loans, are on average fairly long term and mostly fixed rate, whereas deposits are fairly short term, and are either non-interest-bearing or term deposits, which bear interest indexed to short-term rates.

If the difference between long- and short-term rates is large enough, it does not matter whether interest rates are high or low. The same slope generates the same net interest margin (NIM). On the other hand, very low long-term rates of close to zero do not enable a steep enough interest rate curve to generate an adequate NIM. This is with good reason, as deposits with negative interest rates are far from attractive and are difficult for households and small and medium-sized businesses to accept.

Rising interest rates is favorable to the NIM

In practice, banks quickly see an increase in their NIMs if the interest rate curve moves steadily upwards. The reverse also applies. This counter-intuitive effect is due to loans being rolled over faster than savings. When short- and long-term interest rates rise, the average outstanding loan rate rises faster than the average outstanding deposit rate, which is usually indexed to regulated rates.

Conversely, when the curve falls, interest rate adjustments and early home loan repayments gather pace. Households therefore benefit from the drop in interest rates, while liability-side investments by households, in housing savings plans, for example, are rolled over less quickly, as households want to keep the previous, more advantageous rates, for longer.

The European Central Bank’s crucial role in the equation

What impact might inflation therefore have on banks’ NIMs through the change in interest rates? Given what they are announcing, the most likely scenario is that central banks will reduce their quantitative easing by gradually stopping their net purchases of long-term securities on the markets, or tapering, before raising their key rate, i.e. short-term rates. This could have a positive effect on banks’ NIMs, since long-term rates could rise faster than short-term rates, thereby steepening a slope that is currently very flat.

This would also be good policy, as the central banks would gradually stop underpinning financing conditions, as growth and inflation picked up, while allowing banks to effectively finance loan applications thanks to the lessened impact of quantitative easing on profitability. This positive effect should not, however, obscure the impact of the simultaneous disappearance of the support provided to banks by central banks, particularly through tiering and Targeted Longer-Term Refinancing Operations (TLTROs) in the euro zone.

Another factor that should now be considered is volumes. Movements due to the interest rate effect, i.e. the change in NIMs, may be more or less offset by the volume effect, in other words changes in loan and deposit outstandings. In fact, by setting off the interest rate effect against the volume effect you ultimately arrive at the change, by value, in the NIM itself.

A cautious normalisation of monetary policy would theoretically have a positive impact overall. If rates were to rise gradually and fairly smoothly, the resulting volume effect should be relatively neutral. If the central banks went ahead with this normalisation only very gradually, and after announcing it, which is the most likely scenario, this might also limit the ups and downs on the financial markets.

However, if, for one reason or another, the central banks did not respond to a sustained increase in inflation, their credibility would be undermined, and long-term rates would rise more sharply, while short-term rates would be flat. Demand for both housing and investment loans could be affected, possibly generating a negative volume effect, or a less positive effect than under a gradual approach. The bond and equity markets could experience substantial capital losses.

A bleak scenario to be avoided

In such a scenario, the bubbles would deflate more quickly and the shocks to both bank balance sheets, and the balance sheets and profit and loss accounts of banks’ clients, could be more severe, and have repercussions for bank provisions and trading income. Highly indebted companies and states that failed to prepare for the likely rise in interest rates could suffer even greater consequences.

The central banks therefore play a major role. In order to prevent the forming of excessively large bubbles, even if inflation is contained, sooner or later they should normalise their monetary policies so that nominal interest rates are not left too far below the nominal growth rate for too long.

Strong presence of BRED (Vanuatu) Limited

Founded in 2008, BRED (Vanuatu) Limited is the number 1 bank in the loan segment (market share of 36.8%[1] in Vanuatu. BRED (Vanuatu) Limited shows how much the Pacific banking market can be the growth driver for BRED Group.

The €5 million increase brings the issued and paid up share capital to €26 million as at June 21. This increase strengthens BRED (Vanuatu) Limited’s capacities and demonstrates the confidence in the future that BRED has for this region of the pacific, with the opening of a third branch planned for 2022 in the capital Port Vila, near Bauerfield International Airport.

Express growth for BRED Bank Solomon Islands

Established recently in 2018 and despite the pandemic, BRED Bank Solomon Islands has continued with its growth, market penetration and ambitions. The fourth and latest arrival on the Solomon Islands banking market, it took only three years for the bank to set its strong hold and footprint by capturing second place of the loan market with 21.2% [1] share.

This success was reflected in the opening of a second branch in January 2021 in the heart of the business district in the city centre of Point Cruz. This new point of contact close to its customers created around fifteen new jobs.

“Banking without distance” ambassadors

BRED (Vanuatu) Limited and Bred Bank Solomon Islands will use this capital increase to further disseminate the global customer approach and value-added advisory model that define “banking without distance”.

Wherever it is present, BRED’s international network is based on its success in maintaining close relationships with its customers through the work of advisors who support them in all their projects, offering them the best of both face-to-face and digital services.

[1] Figures as at 30/06/2021

About BRED Group

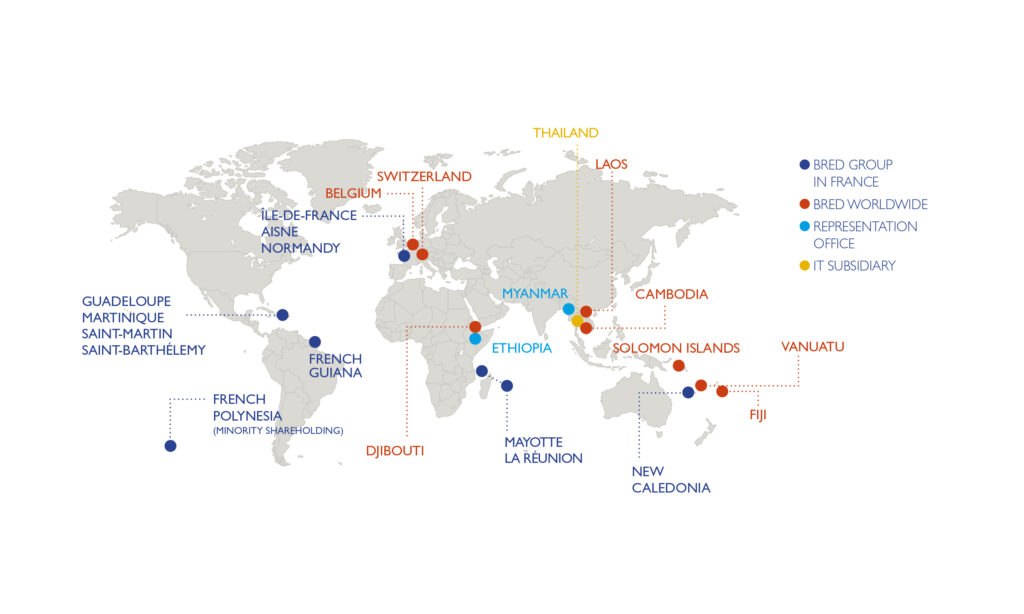

BRED is a cooperative Banque Populaire, supported by its 200,000 members, 5.2 billion euros in equity, and 6,000 employees – including 30% outside France and the French Overseas Departments. It operates in the Greater Paris region, Normandy and in the French Overseas Departments, as well as in Southeast Asia, the South Pacific, the Horn of Africa and Switzerland via its commercial banking subsidiaries.

As a community bank with strong ties in local areas, it has a network of 475 business sites in France. It maintains a long-term relationship with 1.3 million customers.

As part of the BPCE Group, BRED Banque Populaire operates in various activity sectors: retail banking, corporate banking for large– cap companies and institutional investors, wealth management, international banking, asset management, trading, insurance, and international trade financing.

Commercial banking France and the capital markets division continue their strong momentum

In the first half of the year, commercial banking France once again confirmed its very strong momentum, with revenues up 7% compared with the first half of 2020, after a cumulative increase of 45% over the past eight years. This growth was driven by changes in savings deposits and loan outstandings, the increase in market share and better customer equipment, which strongly offset the effects of lower margins. Outstanding customer loans increased by 16.7% and deposits by 8.1% compared with the first half of 2020.These results were made possible by the intensification of the overall close relationship in each of the customer segments in France.

Branches fully dedicated to advisory

This trend in the network is the result of ongoing investments in branches and digital tools, as well as the training of its advisors, which are wholly dedicated to customer advisory services.

In 2020, BRED Group rolled out a branch model fully dedicated to advisory. This new organisation allows our advisors to spend more time on their customers’ projects. Customers choose their methods of interaction: telephone, video or face-to-face at the branch.

This new organisation has led to a sharp increase in meetings and new relationships, while the attrition rate has declined significantly. In addition, the average coverage rate has passed the threshold of 10 products per customer, with significant growth in property and casualty and personal protection insurance. The unit-linked rate in life insurance inflows increased to reach 58%.

A leading business partner

BRED is a major partner for companies of all sizes, SMEs, ISEs, large corporations and institutional investors. BRED has strongly supported its corporate clients during the pandemic, both in credit and in advisory services (€2.3 billion in government-backed loans since April 2020).

It provides tailored solutions in flow management, international development and structured financing.

It is also supported by its trading desk, which posted an excellent performance in the first half, and which is a key player in the European money market. It further strengthened its leading position with more than €100 billion in outstanding negotiable debt securities placed with international investors. BRED is also a recognised player in the private debt segment, also through financing incorporating non-financial criteria (ESG), with more than €1 billion arranged to date on behalf of SMEs and ISEs.

BRED is one of the five French banks and 39 European banks to have been selected by the European Commission as Primary Dealers for the placement of its debt issues under the NextGenerationEU plan. It also places the short-term debt (less than one year) of Austria, Ireland, Belgium, the Netherlands and Estonia.

BRED consolidates its international growth

BRED has strengthened its international presence and posted revenue growth of around 18% at constant exchange rates. It benefited from strong growth in Cambodia and the Fiji Islands, as well as an excellent performance in international trade financing in Geneva.

BRED Group carried out two capital increases to speed its development in Asia-Pacific. A first of USD 35 million for its subsidiary BRED Bank Cambodia, the leading European commercial bank in Cambodia, a second of USD 36.5 million for its subsidiary BRED Bank Fiji, which significantly increased its market share in the first half of the year.

BIC BRED Suisse, its subsidiary specialising in international trade financing, posted a very good performance, mainly due to the 19% increase in its client portfolio in one year and the rise in commodity prices.

Very good half-year results

NET BANKING INCOME INCREASES

FROM 25% TO €764.7m

COMMERCIAL BANKING FRANCE NBI

UP 7%

INTERNATIONAL BANKING NBI

UP 18%

(at constant exchange rates)

COST/INCOME RATIO

OF 53.1%

NET INCOME OF €237m

EQUITY OF €5.2bn

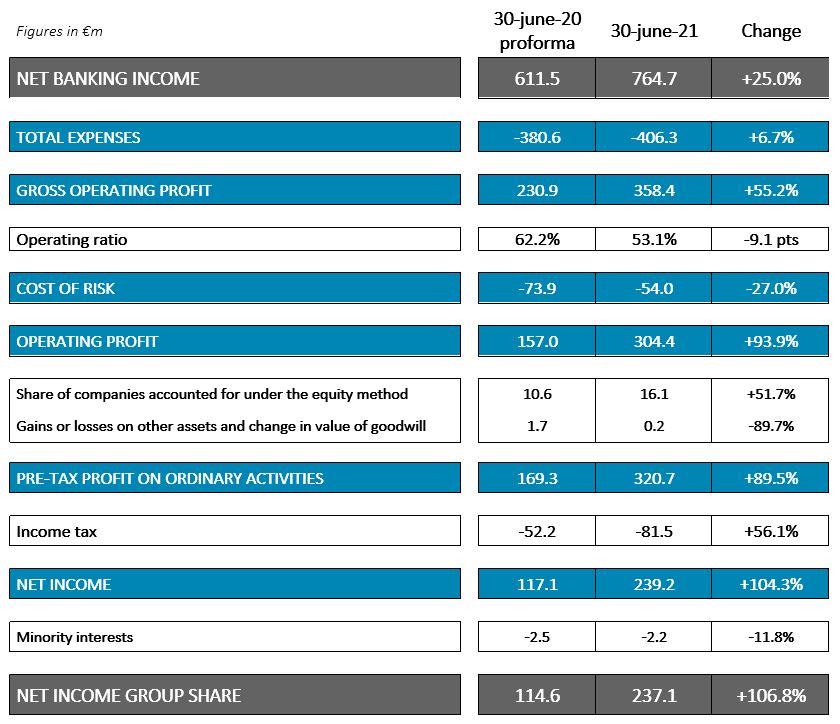

BRED Group posted a sharp increase in consolidated net banking income (NBI): +25% to €764.7m. Excluding exceptional items, NBI increased by 28.1% to €761.5m.

Operating expenses increased by 6.7%, reflecting ongoing investments in IT systems and the digitisation of processes, the modernisation of the branch network, as well as in international development. Restated for the increase in variable remuneration resulting from improved results, operating expenses increased by 2%.

This led to a 55.2% increase in gross operating income (65.5% excluding exceptional items).

BRED thus has a cost/income ratio of 53.1%.

The cost of risk amounted to €54m, down 27%. There was no reversal of provisions on performing loans and receivables (phases 1 and 2) in the first half of the year.

The Group share of net profit for the first half was €237.1m. Excluding exceptional items, it came in at €235.1m.

Shareholders’ equity amounted to €5.2 billion at 30 June 2021, with an excellent overall solvency ratio of 17%.

About BRED Group

BRED is a cooperative Banque Populaire, supported by its 200,000 members, 5.2 billion euros in equity, and 6,000 employees – including 30% outside France and in the French Overseas Collectivities. It operates in the Greater Paris region, Normandy and in the French Overseas Departments, as well as in Southeast Asia, the South Pacific, the Horn of Africa and Switzerland via its commercial banking subsidiaries.

As a community bank with strong ties in local areas, it has a network of 475 business sites in France. It maintains a long-term relationship with 1.3 million customers. As part of the BPCE Group, BRED Banque Populaire operates in various activity sectors: retail banking, corporate banking for large– cap companies and institutional investors, wealth management, international banking, asset management, trading, insurance, and international trade financing

BRED Group 2021 interim results

NET BANKING INCOME UP BY + 25.0 %

(+ 28.1 % excluding non-recurring items)

ALL BUSINESS LINES STRONG CONTRIBUTORS TO NBI GROWTH:

COMMERCIAL BANKING IN FRANCE (+ 7.0 %)

INTERNATIONAL DIVISION (+ 18.3 % at constant exchange rates)

CAPITAL MARKETS DIVISION (+ 25.0 %)

INVESTMENTS ACTIVITIES (+ €110M)

STRONG COST-TO-INCOME RATIO OF 53.1 %

NET INCOME OF €237.1M

BRED’s half-year consolidated net banking income (NBI) significantly increased, rising 25% to €764.7m [1]. Adjusted for non-recurring items, NBI increased by 28.1%, totalling €761.5m. Compared to the first half of 2019, this trend is confirmed with a 22.4 % increase in BRED’s consolidated NBI.

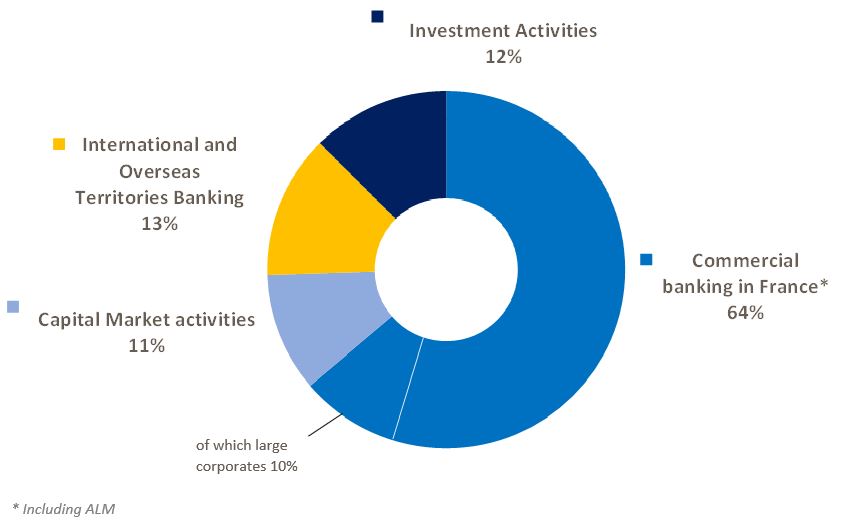

All business lines contributed to this remarkable growth:

– Commercial Banking in France (including ALM) posted good NBI growth of 7.0 %. The momentum of added value advisory services and increased market shares more than offset the effects of narrowing margins. Customer loan outstandings rose by 16.7 % over the half-year period.

– The International and Overseas Territories Banking division posted a 18.3 % increase in NBI at constant exchange rates. It benefited from strong growth in its activity in Cambodia and Fiji Islands, as well as excellent performances in international trade financing in Geneva.

– Capital Markets activities achieved an excellent first half with NBI up by €18m (+25.0%), reflecting the ongoing strengthening of BRED’s position as a supplier of liquidity and investment solutions to large institutional clients.

– Lastly, the NBI of the Consolidated Investment Management division rose by €110m, due to the strong performance of the private equity portfolio following a subdued year in 2020.

Breakdown of NBI by division

Operating expenses rose by 6.7 % on a reported basis (7.0 % excluding non-recurring items), reflecting proactive investments in technology, branch network modernisation and international development. Variable payroll costs have also been readjusted in line with interim results. Excluding these costs, growth in operating expenses amounted to 2.0 %.

Gross operating profit, up by 55.2 % (65.5 % excluding non-recurring items) has been positively impacted by the sharp rise in NBI and relatively lower rise in expenses. BRED posts a cost-to-income ratio of 53.1 % (on accounting result and 53.3 % excluding non-recurring items), a leading level of performance among French banks and a reflection of the effective conversion of costs into NBI.

The cost of risk stands at €54.0m, down by 27.0 %. No reversals of provisions on performing loans (stages 1 and 2) were made in the first half of the year.

The half-year net result group share reached a record level of €237.1m, more than double that of 2020 half-year. Adjusted for non-recurring items, it stands at €235.1m.

BRED consolidated income statement

[1] Proforma of the BPCE financial equation in 2019 and 2020. BPCE SA’s rules for re-invoicing expenses recognised in respect of its duties as a central institution changed in Q4 2020 with retroactive effect for 2020 et 2019.

[2] The NBI of the banking subsidiaries and controlling interests abroad is stated here in accordance with the percentage of the holding, independently of the accounting treatment.

This change, which reflects a profound shift in our societies, and which confirms the need to move away from shareholder capitalism toward partnership capitalism, points to the renewed relevance of cooperative and mutualist banks. They view their customers as a fundamental stakeholder since, as partners, they hold their capital, constitute and represent their governance (in the general meetings, on the boards of directors, and on the supervisory boards which control the executive). The governance of cooperative and mutualist banks is, therefore, organised in such a way that they are naturally “customer centric”.

In addition, the banks instinctively think in terms of regions and territories. This is because their board members are drawn from among customers living in the areas where they are located and where they conduct their business.

Employees, for their part, are more involved in the strategy pursued, given the size of the banking ISEs in question. In some companies, their representatives already took part in board meetings, even before it became a requirement.

Cooperatives and mutualist banks are often, by their nature, economically and socially committed to their territories because they live in osmosis with them. If things are going well, they contribute to the health of their regions. If the regions are doing well, the regional bank’s growth is facilitated. Their economic involvement is, therefore, a prerequisite for their existence. In this respect, it is absolutely indispensable for banks to continue to finance their region, even when it is experiencing an economic downturn. There is no savings fungibility for regional banks which would justify moving and reallocating savings to the detriment of a region based on the sole argument that the profit/risk ratio would be better there than here. The savings held by cooperative and mutualist banks are, therefore, used to fund the life and company projects of local customers and to support the local economy, regardless of the current environment.

This commitment is also seen in their CSR approach. They make a point of using a portion of their profits to finance general interest missions. These include cultural and sports initiatives, both of which promote social cohesion, and the transmission of knowledge and equal opportunity, which also contribute to cohesion by their very nature. The same holds true for the energy transition.

Cooperative banks are fully involved in the economic dynamic and social cohesion of the regions. This dynamic requires a strong local presence which contributes to making the banks unique. Relational, decision-making and managerial proximity is very important. The relationship between customer and bank must be sustainable and it conditions the ability of banks to do their job well and be profitable. In addition, the credit decisions of cooperative and mutualist banks are taken locally, in the region. Lastly, given the size of these banks and the regional presence of their management, who are true banking ISE entrepreneurs, managerial proximity is very strong. This is essential because retail banking is a services product and the ability to mobilise teams for the benefit of customers can be highly differentiating. This also ensures that they are responsive and can quickly adjust their strategy and their organisation to better meet the changing needs of customers and support their profitability.

The fact that regional cooperative and mutualist banks are not listed and are not dependent on the stock markets means that their vision is not limited by the short-term approach which sometimes defines the exchanges or by the often mimetic imperatives seen on the financial markets.