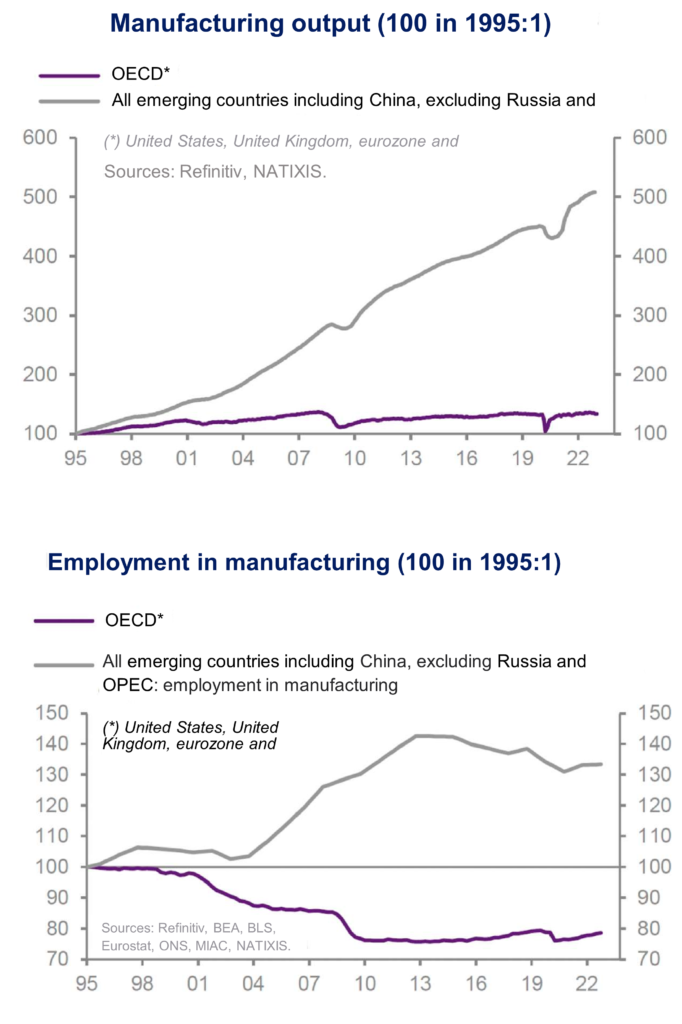

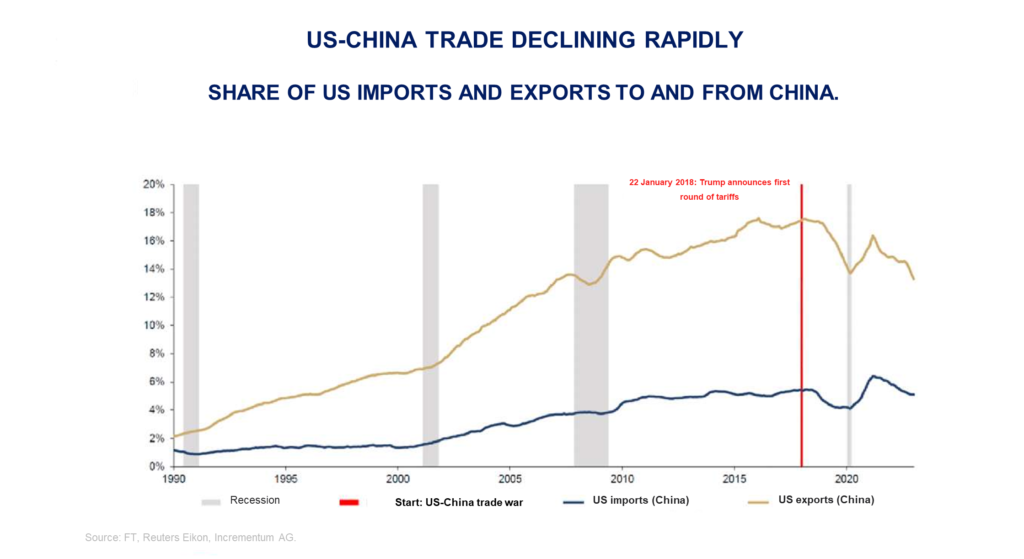

Growing geopolitical tensions have and will have lasting effects on international trade (including the reorganisation of goods flows) and on the international monetary system. These tensions are generating global fragmentation by heightening commercial and financial polarisation between the increasingly marked zones of influence of the two superpowers, the United States and China, even if many countries would like to keep them at an equal distance. This situation follows several decades of globalisation in terms of trade, investment and finance, having served to significantly reduce world poverty and the gap between advanced and non-advanced countries and resulting in a lasting period of disinflation. But they have also led to profound upheavals in national industrial structures, with necessary and sometimes painful reorientations.

The economic, financial and social risks involved in planetary fragmentation are the subject of increasing debate. And major international bodies are rightly concerned about the fragmentation process under way. Globalisation has significantly reduced inequalities between rich and poor countries. In 1981, 40% of the world’s population lived below the extreme poverty line, compared with just 10% today. In China and India, for example, two billion people have risen above the poverty line. And what is true of income is also true of health, with the difference in life expectancy between advanced and non-advanced countries having narrowed considerably. The effects of highly developed international trade and globalised capital markets are, by these standards, clearly established.

We also know that the optimal functioning of globalisation hinges on mutually accepted and respected rules regulating international trade and on national policies serving to support transformations in production structures and the nature of the resulting jobs. But in the last ten years, the acknowledgement of the indispensable nature of these international rules and regulations has been undermined, particularly by China’s growing thirst for power and the attendant reaction of the United States.

Sino-American tensions are clearly central to these concerns. The rise in US protectionism largely initiated in the policy proposals of Donald Trump has continued under the Biden administration, with security measures restricting technology exports and the recent introduction of the Inflation Reduction Act. In the opposite camp, China persists with its numerous anti-competitive policies, both explicit and implicit.

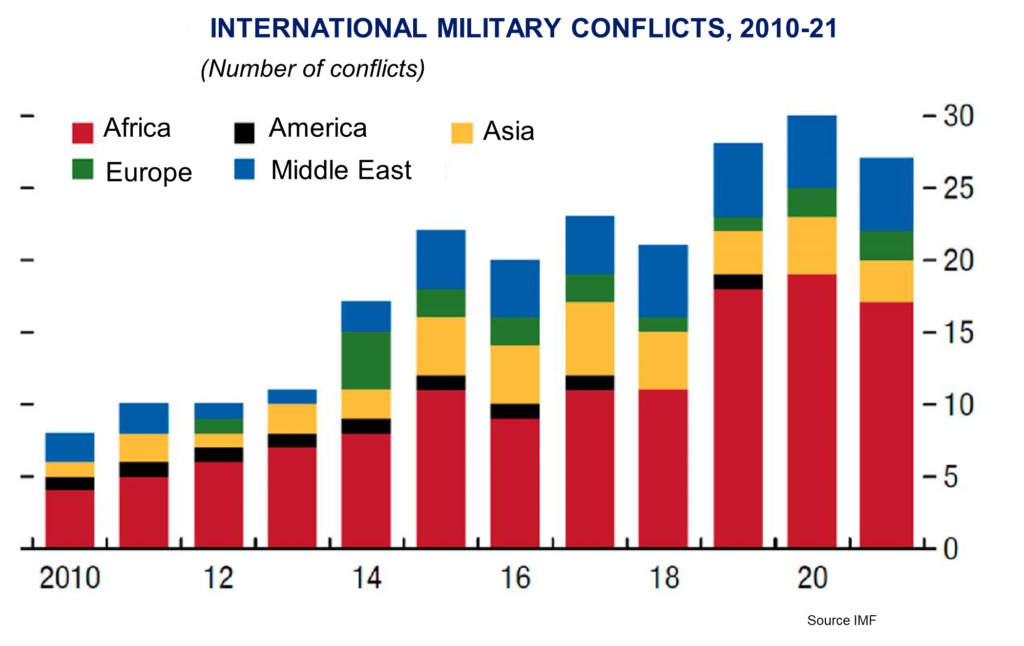

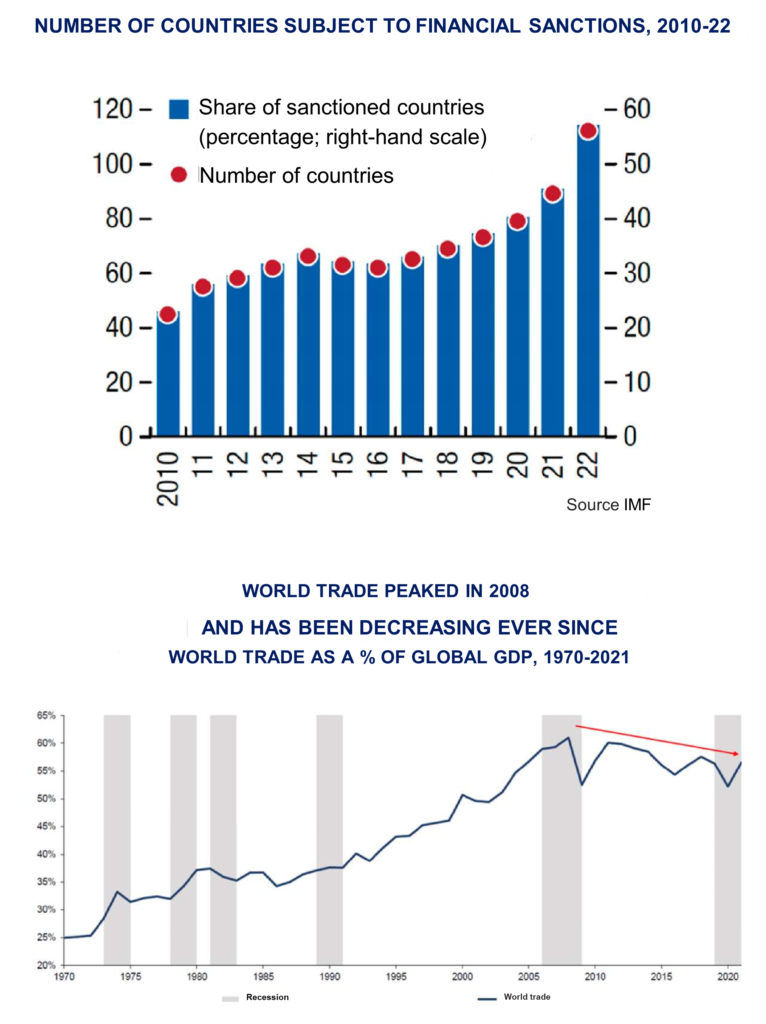

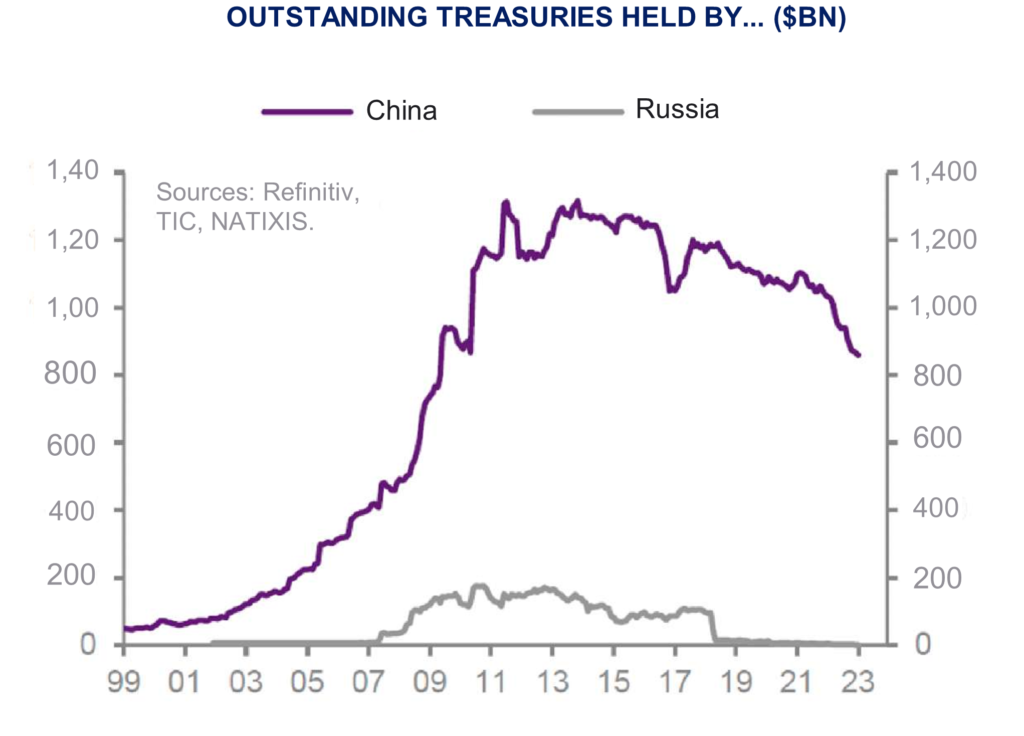

The consequences of COVID, Brexit and the war in Ukraine have also contributed to the reorganisation of trade routes and capital flows. The risk of fragmentation has been reinforced by the conflict in Ukraine and the resulting increase in sanctions affecting trade, investment and the assets of sanctioned institutions and individuals.

These observations, like the economic and financial implications mentioned here, are not analysed from a moral standpoint, nor from the realistic standpoint of the balance of power between nations with opposing political regimes. Today’s growing global fragmentation has de facto effects beyond the intentions having driven the trend.

Partial de-globalisation, such as the relocation of production plants, could have favourable consequences for the climate and, in all likelihood, for the number and nature of jobs for the middle classes in advanced countries. But the resulting rise in structural inflation will erode their purchasing power. Symmetrically, it will slow down catch-up on the part of less advanced countries, with the corresponding social impact. Lastly, the reduced mobility of capital resulting from fragmentation will create fewer opportunities for financing, especially for development projects in less advanced countries. And it will increase the cost of borrowing.

Increased geopolitical tensions and the resulting sanctions, de facto and de jure, reduce the international mobility of capital in financial markets as well as in cross-border bank lending.

Consequently, financial vulnerabilities are also expected to increase, as capital could become scarcer for some countries, banks less internationally financed and therefore more fragile, and “sudden stop” or currency crises more frequent. This could undermine global financial stability. And overall – trade, investment and finance combined – it is likely to reduce global growth.

This process of fragmentation will also impact the international monetary system, potentially transforming it. What role will the US dollar and Chinese renminbi play in the future? Can and will the dollar lose more and more clout in foreign exchange reserves and international payments? The issue is important both macro-financially and for US power itself.

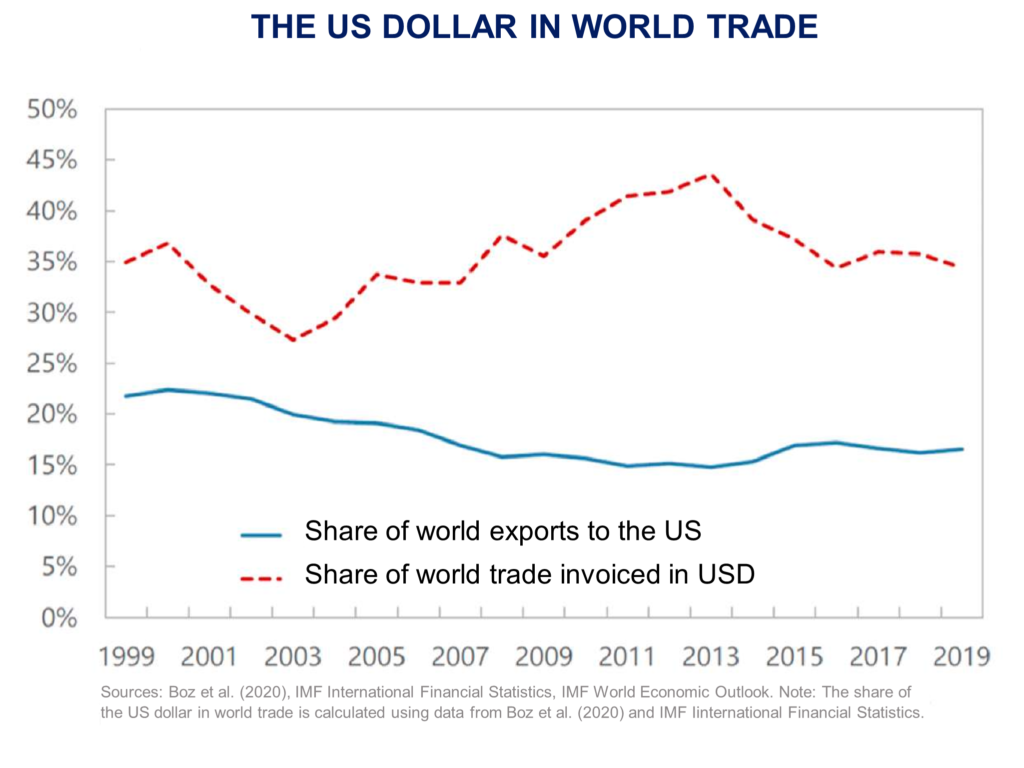

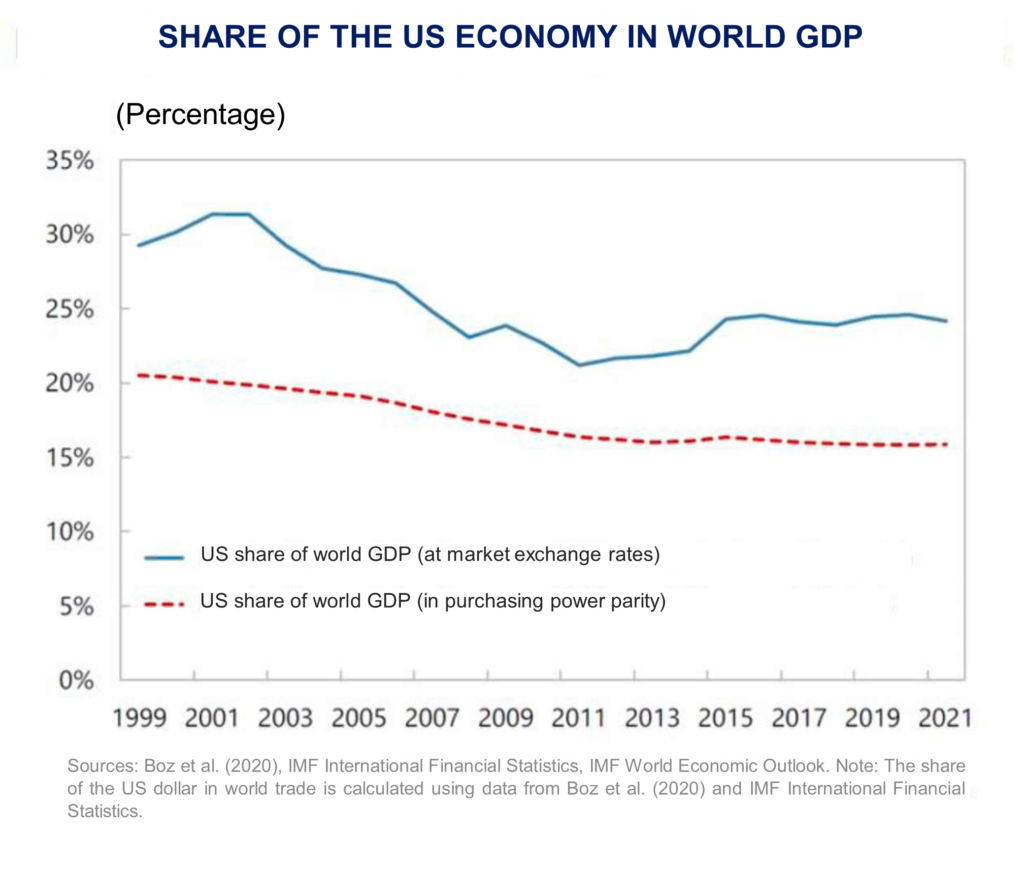

The dollar’s share of international trade has held steady over the last 20 years, while the relative weight of the US economy in world trade and GDP has declined slightly, measured in purchasing power parity.

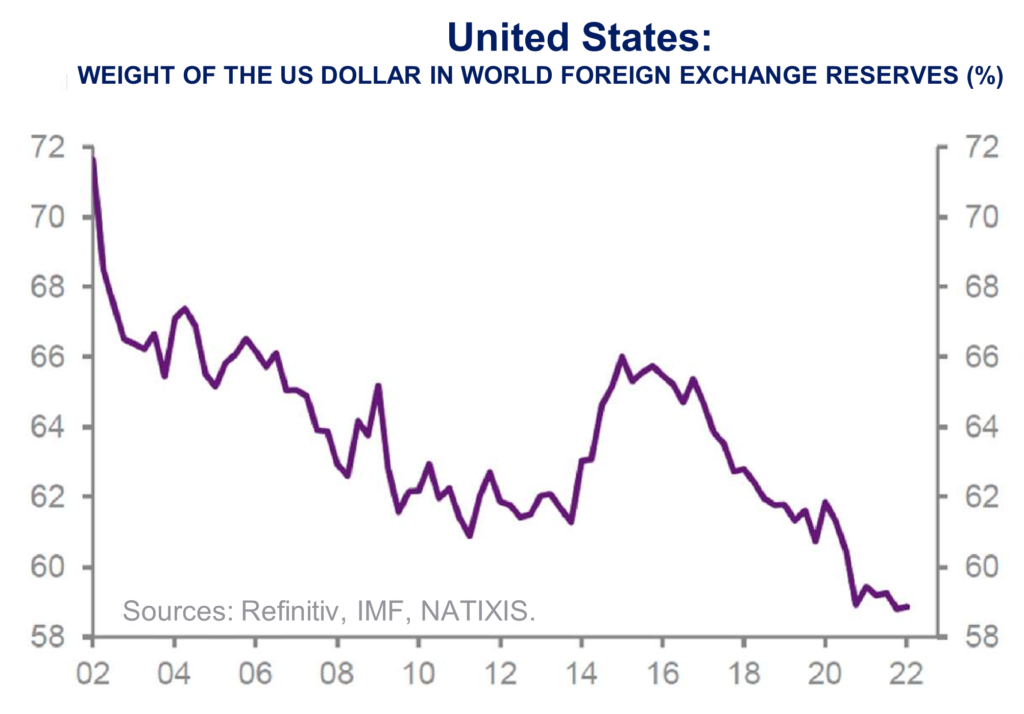

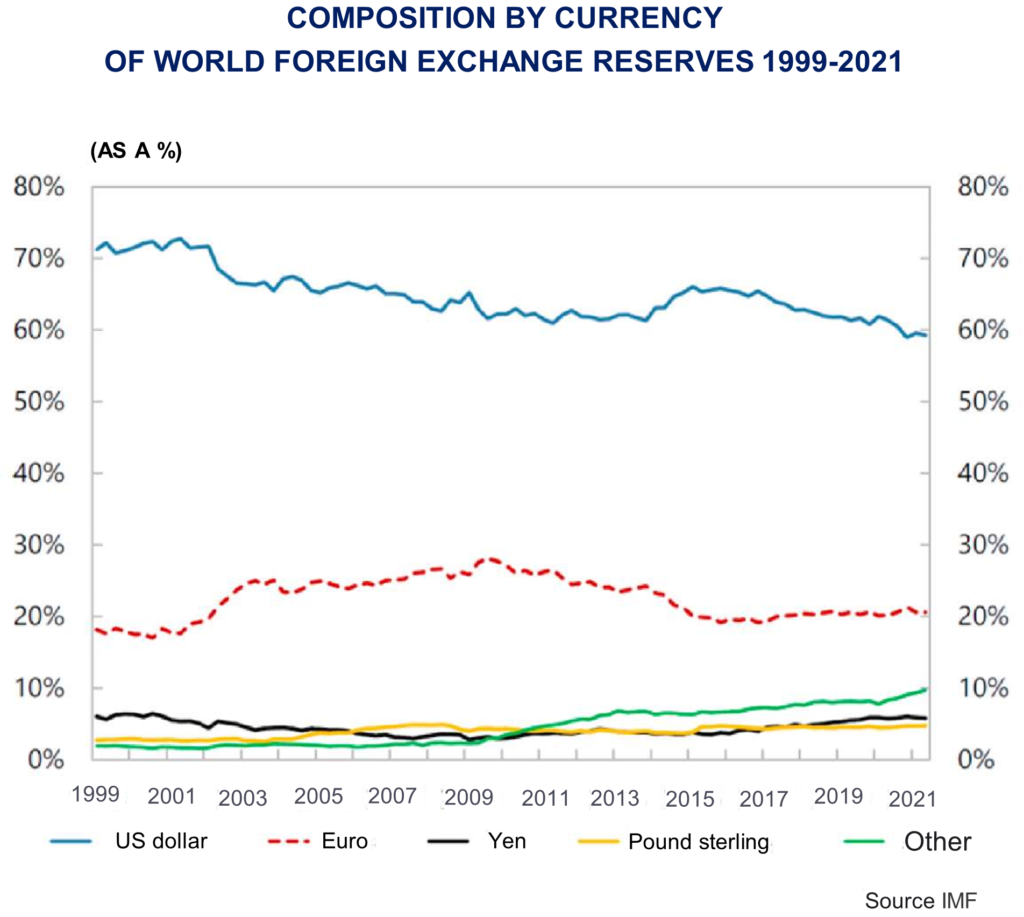

In contrast, the share of the US dollar in central bank reserves has fallen by over 10 percentage points. This has not benefited the euro, sterling or yen, which generally stand to gain from the diversification of foreign exchange reserves. Instead it has benefited the renminbi, for one quarter of the decrease, along with other currencies including those of Australia, Canada, South Korea and Singapore, for the remaining three quarters. In addition, gold has once again become a source of reserve diversification, particularly for emerging central banks.

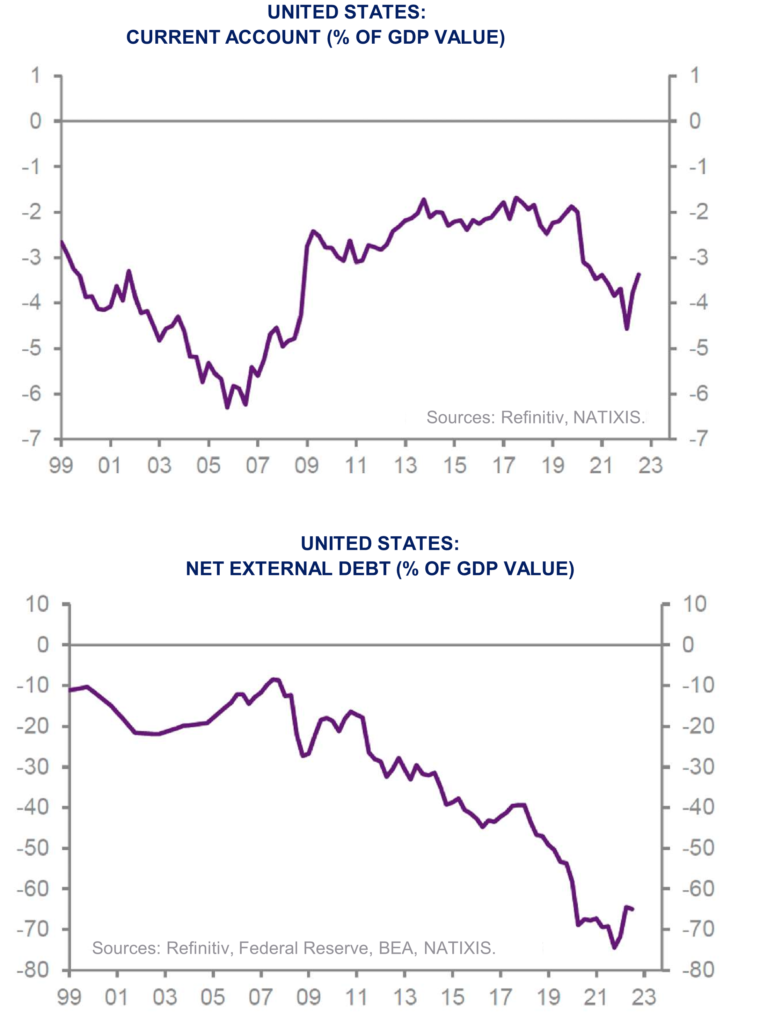

The US fundamentally needs the US dollar as a de facto, if not de jure, international currency. The country’s current account is structurally and significantly in deficit and its net external debt is constantly growing (from 10% of GDP in 2000 to roughly 70% today).

As such, the US dollar’s role as the world’s reserve and transaction is essential to the United States’ maintaining its position as a superpower. It enables the country to refinance its deficits problem-free and reduces its borrowing costs. China perfectly understands this correlation between global power and global currency and is patiently building the basis for the internationalisation of its own currency. China is encouraging countries having entered its zone of influence to gradually break free from the greenback or invoice and trade less in the currency. It is also gradually building the necessary infrastructure by creating future offshore renminbi clearing houses.

In another key factor, the United States, by using the dollar to develop the extraterritoriality of its law, and to impose sanctions (including the freeze on Russian central bank reserves), could run the risk of precipitating the decline in the use of the dollar as both an international transaction currency and a reserve currency. The monetary weapon of power is thus double-edged, as the refinancing of deficits and the vertiginous external debt of the United States would not be able to withstand a gradual de-dollarisation of transactions and reserves.

Symmetrically speaking, as long as Chinese government policy largely dominates the economy, it will be extremely difficult for the renminbi to internationalise. To be successful, a currency needs to inspire trust. Money is a debt, a bank debt relative to non-bank economic agents in a country. And internationally, money stands as a country’s debt. Which is why across-the-board trust in political, military and economic power is essential. But this trust also depends on how the currency is regulated and, hence, on the validity and stability of the institutions that define and supervise the currency. If it were to occur, the de-dollarisation process would therefore be extremely gradual, taking place over the long term.

Today’s fragmentation trend is a clear consequence of ongoing global disorder and polarisation. Political, military, economic and demographic forces, as well as the greater or lesser wisdom of leaders and peoples, will determine the final shape (on a transitional basis at least) of today’s transformations. These developments will impact growth, standards of living, quality of life and financial stability around the world.

Bibliography:

- Geo-economic fragmentation and the world economy

Shekhar Aiyar, Anna Ilyina

27 March 2023 – Vox Eu columns

- Confronting Fragmentation Where It Matters Most: Trade, Debt, and Climate Action

Kristalina Georgieva

16 January 2023 – IMF

- Geopolitics and Fragmentation Emerge as Serious Financial Stability Threats

Mario Catalán, Fabio Natalucci, Mahvash S. Qureshi, Tomohiro Tsuruga

5 April 2023

- The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies

Serkan Arslanalp, Barry J. Eichengreen, Chima Simpson-Bell

24 March 2022 – IMF

- Le passage à une situation de multiples monnaies de réserve (The transition to a multiple reserve currency situation)

Patrick Artus

5 January 2023, Flash Economie

- Le système monétaire international et le financement des Etats-Unis (The international monetary system and the financing of the United States)

Patrick Artus

30 March 2023, Flash Economie