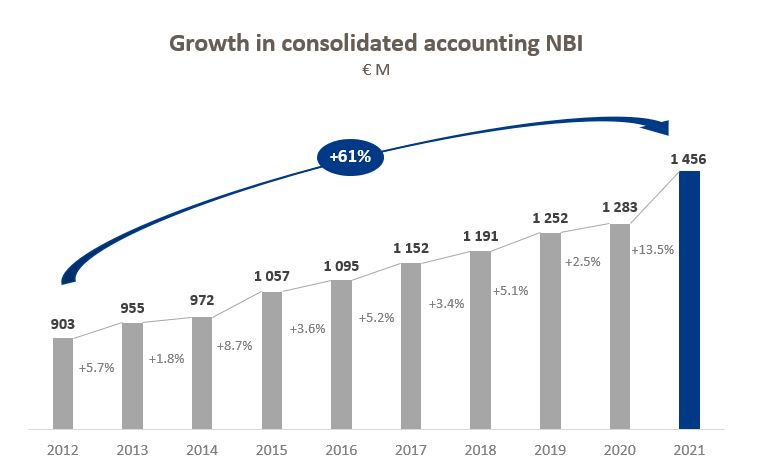

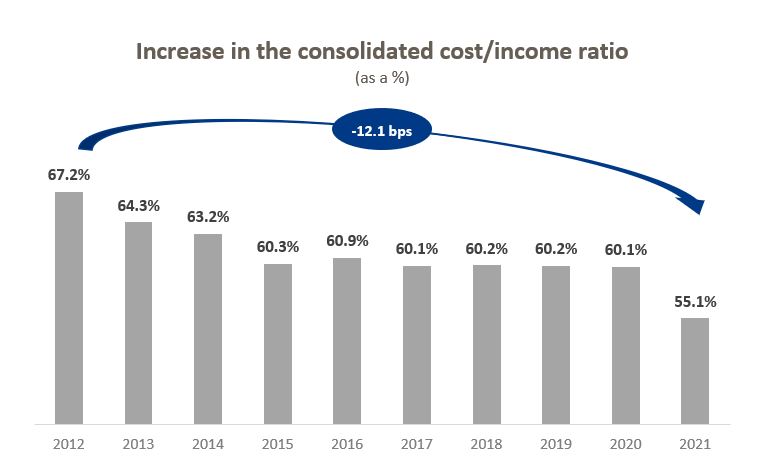

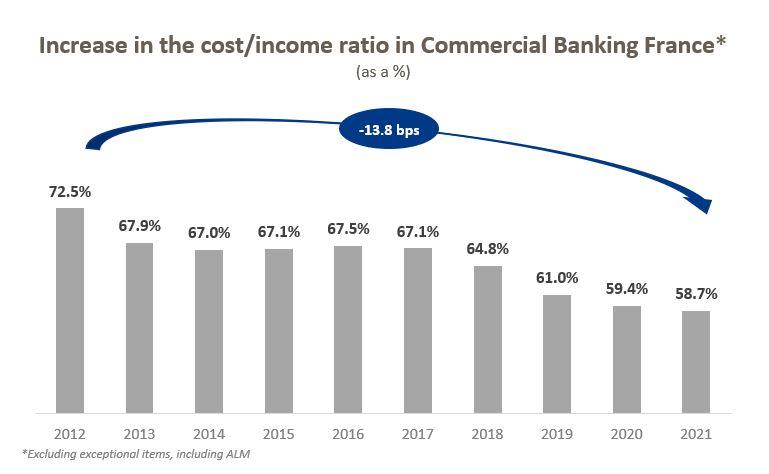

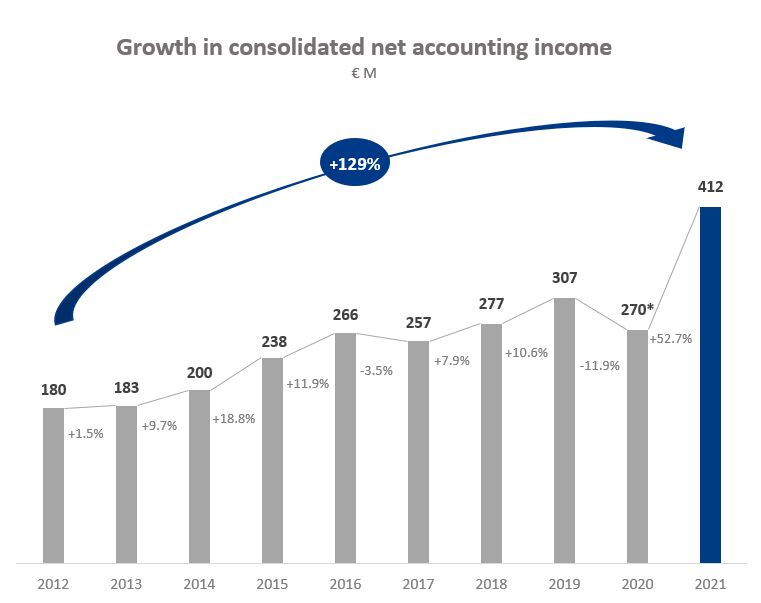

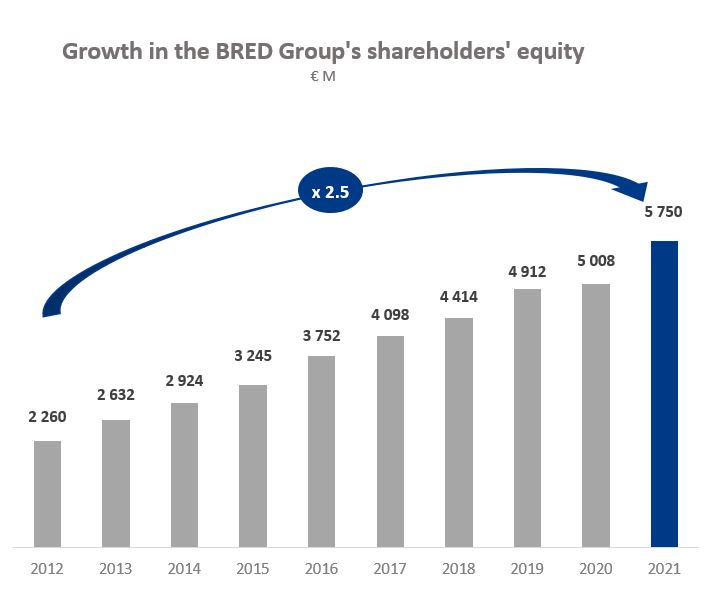

| SUSTAINED AND REGULAR GROWTH IN NBI SINCE 2012 HISTORIC RESULTS IN 2021 In 2021 : INCREASE IN NET BANKING INCOME OF +13.5% NET BANKING INCOME €1,456.1 M GROWTH IN NBI IN COMMERCIAL BANKING FRANCE (+5.4%) AND THE INTERNATIONAL DIVISION (+25.7% at constant exchange rate) CAPITAL MARKETS DIVISION RESULTS MAINTAINED AT A HIGH LEVEL EXCELLENT COST/INCOME RATIO AT 55.1% NET INCOME OF €412.4 M, UP 52.7% NEW SUCCESSFUL CAPITAL INCREASE (€120 M) TO SUPPORT BRED’S DEVELOPMENT STRONG GROWTH IN SHAREHOLDERS’ EQUITY TO €5.8 bn (+14.8%) VERY GOOD CET1 CAPITAL ADEQUACY RATIO AT 16.5% |

“Our very good results for 2021 across all of our activities are part of a long chronicle of growth. They are driven by the intensification of the global value-added relationship of proximity in each of our customer segments, from individuals to companies of all sizes, in France and internationally. Our banking without distance strategy, with the deployment of 100% advisory branches since 2019, is once again showing its full relevance. Its cost/income ratio and the trend in shareholders’ equity underscore the solidity of the BRED Group,” explains Olivier Klein, Chief Executive Officer of the BRED Group.

Earnings on the increase, with sustained NBI growth over the past 9 years

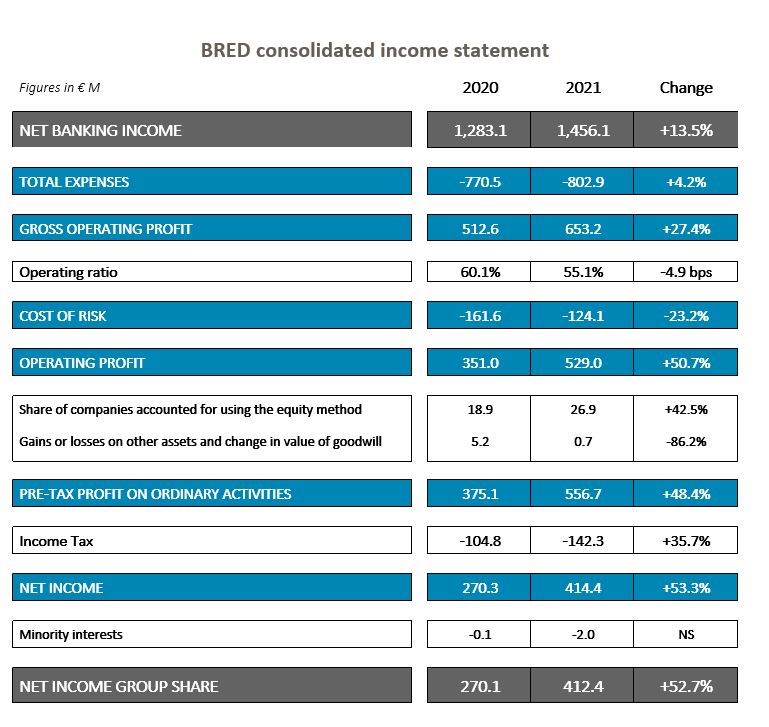

The BRED Group recorded a sharp increase in net banking income (NBI) (13.5%) to €1,456.1 M.

These figures bear witness to the success of the banking without distance strategy implemented by BRED over the past few years, both in France (mainland, overseas departments and New Caledonia) and in the emerging countries in which it operates: Djibouti, Cambodia, Laos, Solomon Islands, Vanuatu and Fiji, focusing on both digital and high value-added consulting.

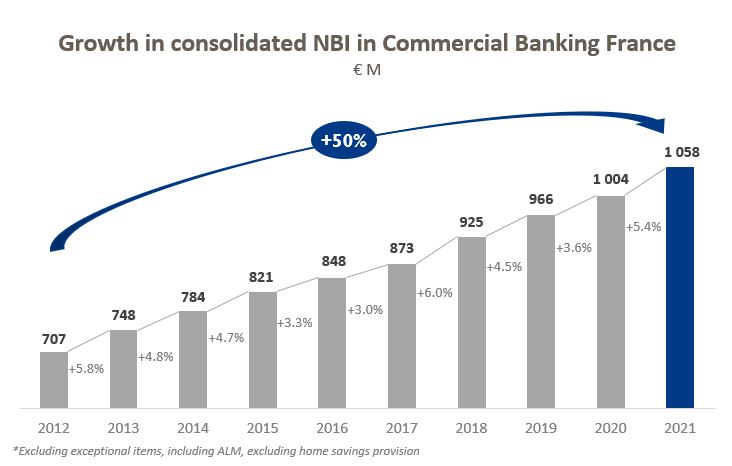

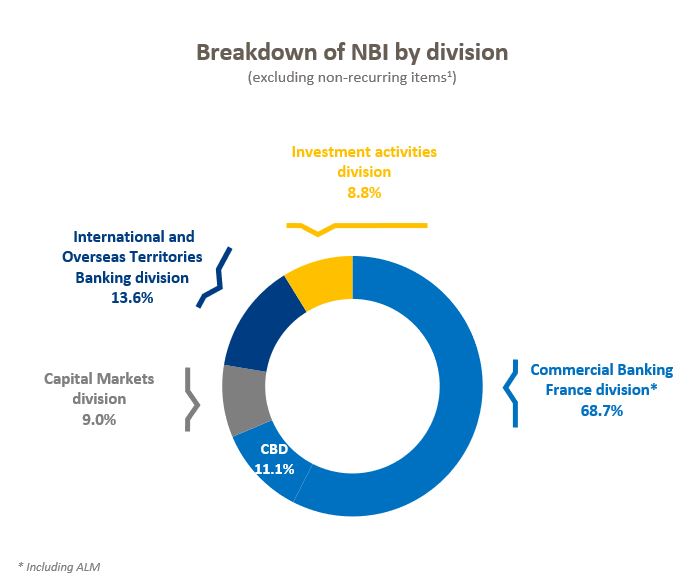

The remarkable growth in NBI is driven by all business lines and in particular commercial banking in France (including ALM), which recorded an increase in NBI of 5.4% and continuous cumulative growth from 2012 to 2021 of 50%. This is due to the banking without distance model which fosters a global value-added proximity relationship with each customer segment. The increase in outstanding customer loans (+14%) remained very dynamic over the whole of 2021. The BRED network also continued to mobilise its efforts to support the economy and its customers, with nearly 15,000 state guaranteed loans (PGE) for an amount of €2.3 bn disbursed since the system was put in place.

The International and Overseas Territories banking division posted a 25.7% increase in NBI at constant exchange rates. It benefited from an excellent performance in the financing of international trade in Geneva and from the strong growth of its commercial banking activity, particularly in the Fiji Islands and Cambodia.

The Capital Markets activity maintained a very good level of results and contributed 9% to the BRED Group’s NBI.

The consolidated investment management business grew strongly due in particular to the excellent performance of the private equity portfolio.

[1]The NBI of the banking subsidiaries and controlling interests abroad is stated here according to the percentage of the holding, irrespective of the accounting treatment.

Operating expenses increased by 1.7% restated for non-recurring items and the increase in variable remuneration resulting from the improvement in results. This reflects the continuous effort of investment in information systems and the digitization of processes, investment in the modernization of the branch network and in training, as well as in international expansion. Total operating expenses increased by 5.5%.

Gross operating income, up 27.4% (28.1% excluding non-recurring items), benefited from the sharp increase in NBI.

Down by more than 12 points since 2012, the cost/income ratio stood at 55.1% (on accounting income and 55.2% excluding non-recurring items), an excellent level for the French banking sector.

The cost of risk amounted to €124 M, down 23%, with no reversal of provisions on performing loans (stages 1 and 2).

Net income, BRED Group share reached a record level of €412.4 M, up 52.7%.

*The decline in 2020 is due to the prudent provisioning of the cost of risk potentially generated by the pandemic.

Very strong solvency and liquidity ratios

Shareholders’ equity amounted to €5.8 bn, up 14.8% over the year thanks to the excellent level of net income and a capital increase of €120 M. The CET1 capital adequacy ratio stands at a very good level of 16.55% and the overall ratio at 16.77%.

The Liquidity Coverage Ratio (LCR) stood at 138% at December 31, 2021 for a minimum regulatory requirement of 100%. BRED’s Net Stable Funding Ratio (NSFR) came in at 109% at 31 December 2021 for a minimum regulatory requirement of 100%.

About BRED

BRED is a cooperative people’s bank, supported by its 200,000 members, €5.8 bn in equity and 6,300 employees – 30% of whom work outside mainland France and the French Overseas Departments. It operates in the Greater Paris region, Normandy and in the French overseas territories, as well as through its commercial banking subsidiaries in Southeast Asia, the South Pacific, the Horn of Africa and Switzerland.

As a community bank with strong ties in local areas, it has a network of 475 locations in France and abroad. It maintains a long-term relationship with 1.3 M customers.

As part of the BPCE Group, BRED Banque Populaire operates in a variety of activity sectors – retail banking, corporate and institutional banking, wealth management, international banking, asset management, trading, insurance, and international trade financing.

In 2021, BRED generated consolidated NBI of €1.46 bn (+13.5%) and its net income amounted to €412 M, up 52.7%.